Permanent Account Number (PAN) is a unique identification code given by the Income tax department. PAN is essential for various purposes like filing the income tax returns, opening bank account, GST registration, etc. The process of procuring a physical PAN card is lengthy and requires a minimum of 15 days. To overcome these difficulties the […]

Income under the Income Tax regime are classified under five heads namely Salary, Profits/Gains From Business Profession, Income from House Property, Capital gains and the residual category i.e. Income from other sources. Every income which is not specifically exempt is liable to income tax in the Financial year in which it is received/ accrued. However, […]

Introduction Central Board of Indirect taxes and Customs vide Notification no. 62/2020 dated 20th August,2020 made it mandatory for taxpayers obtaining new registration under GST to authenticate the application by way of Aadhar Authentication i.e. Aadhar OTP. The applicants failing to do so shall be subject to a site visit by the department before the […]

The GST council in the 39th Council meeting held on 14-03-2020 had recommended that interest on delayed payment of GST liability to be charged on the net amount rather than the gross amount. Prior to this, this subject has always been debated as many taxpayers received notices from the department demanding interest on the Gross […]

Introduction of Section 80EEB of Income Tax Act,1961 With the intention to encourage people to buy Electrical Vehicles, Deduction under section 80EEB was introduced on interest on loan taken to purchase Electric Vehicle. Quantum Of deduction Under the section, lower of the following is available as deduction Actual Interest paid on loan. 1,50,000/- Eligibility This […]

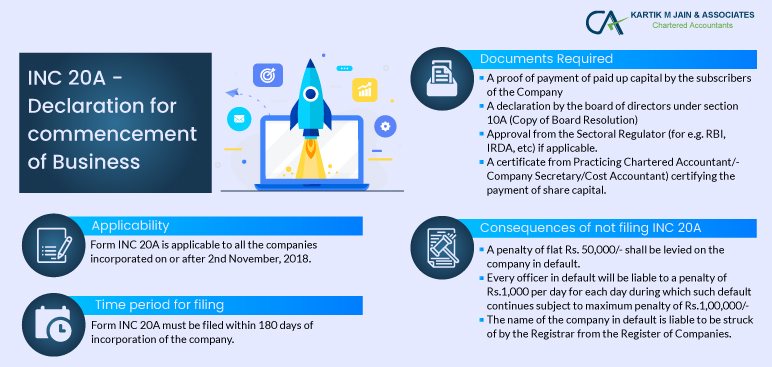

The Companies (Amendment) Ordinance,2018 requires a company registered on or after 2nd November,2018 to file a declaration of commencement of Business in Form INC 20A on the MCA website. This was done with the objective of eliminating shell companies and enhance corporate compliance. Applicability Form INC 20A is applicable to all the companies incorporated on […]

ITR -1 and ITR -4 forms have been notified by the Central Board of Direct Taxes (CBDT). However, the above forms have a few new disclosures to be made if applicable. Here is the list of such disclosures:- 1) Passport Number:- If you hold a passport, you are required to furnish the passport number if […]

While there are many benefits of filing your Income tax return on time, Not filing Your ITR may attract the ire of the Income Tax department. Penalty, Interest, Best Judgment Assessment and Prosecution are some of the consequences you may face for not filing your income tax return. This article throws light on the consequences […]

On 13th August 2020, Our Honorable Prime Minister Shri. Narendra Modi launched the Platform for “Transparent Taxation”. One of the key feature of the event was unveiling and implementation of the “Taxpayer’s Charter” which clearly outlines the Governments’ responsibilities towards the taxpayers as well as the duties of the taxpayers. Outlined here are your key […]

Finance Act,2017 inserted a new section 194 IB which mandates deduction of rent payable by certain class of Individual/HUF to a resident individual. This article throws some light on the said provision. Applicability:- This section is applicable to Individuals or HUF taxpayers paying rent in excess of Rs. 50,000 per month to a resident. For […]