The Indian Tax system is divided into two types, namely Direct Taxes and Indirect Taxes. Direct taxes are the part of the earnings which a person directly pays to the government. On the other hand, indirect taxes are paid by the consumers of goods and services in addition to the price of such goods and services. Example of Indirect taxes are Goods and Service Tax (GST), Customs duty, etc.

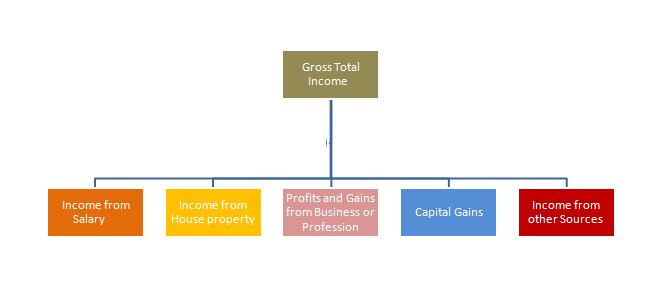

The direct taxes paid to the government are further classified into 5 types. They are called as Heads of Income. The total income earned by a person is called as Gross Total Income (GTI). As per section 14 of the income tax act, 1961 Income of a person is computed under the following five heads:

The Income Tax Act has set different rules and provisions in order to find out the total taxable income in each of the above heads. In this article we will focus on computing the total taxable income in respect to capital gains arising from sale of property.

Meaning of Capital Gains

In accounting, when a non-trading commodity or a product is sold for a profit the profit earned is called as a Capital profit. In income tax terms the definition of capital profit/capital gain a little different.

To understand the meaning of capital gain it is first important to understand the meaning of capital asset. As per sec 2 (14), Capital asset means a property of any kind, fixed or circulating movable or non-movable, tangible or intangible. It includes;

• property of any kind held by assessee

• any right in or in relation to an Indian company, including rights of Management or control or any other rights.

• any securities held by a Foreign Institutional (Portfolio) Investor which has invested in such securities made under SEBI, 1992

Thus any profit made on sale of the above transaction would be regarded as Capital Gain

Nature of Capital Gain

The incidence of tax depends on the nature of Capital gain. The nature of capital gain is based on the period of holding of the asset.

| Type of asset | Period of Holding | Nature of Gain |

|---|---|---|

| Listed Equity Shares, Listed Preference shares, Listed debentures/bonds, units of UTI, units of equity oriented mutual funds, zero coupon bonds |

More Than 12 Months

Less Than 12 Months |

Long Term Gains

Short- term Gains |

| Unlisted Equity Shares and unlisted preference shares (1st April 2016 onwards) |

More than 24 months

Less than 24 Months |

Long term gain

Short – term Gain |

| Immovable Property, e.g.- land or building or both | More than 24 months

Less than 24 Months |

Long term gain

Short – term Gain |

| All other assets such as gold, diamonds etc | More than 36 months

Less than 36 Months |

Long term gain

Short – term Gain |

Capital gain arising from sale of property

Capital gains are taxable only when the following conditions as per section 45 are satisfied

1. The asset under consideration is a Capital Asset

2. There is a transfer of such capital asset. Transfer includes sale, exchange, relinquishment.

3. The transfer of the Capital asset has happened in the relevant previous year

4. There should be profit or gain arising from transfer of such capital asset.

Thus when a house property is sold at a profit in the previous year, the gain arising from such property will be taxed as Capital Gain

Computation of Capital Gain arising from transfer of Property

As discussed above the incidence of taxation depends upon the nature of gain i.e., Short -term or long term. Similarly the computation also depends upon the nature of gain.

Short – term Gain

| Particulars | Amount Rs. | Amount Rs |

|---|---|---|

| Full Value of Consideration | — | — |

| Less: Transfer Expenses | — | — |

| Net Sale Consideration | — | — |

| Less: Cost of Acquisition | — | — |

| Less: Cost of Improvement | — | — |

| Hence, Short term capital Gain | — | — |

| Less; Exemptions u/s 54B, 54D, 54G, 54GA | — | — |

| Taxable Short term Capital Gain | — | — |

Long Term Gain

| Particulars | Amount Rs. | Amount Rs |

|---|---|---|

| Full Value of Consideration | — | — |

| Less: Transfer Expenses | — | — |

| Net Sale Consideration | — | — |

| Less : Cost of Acquisition | — | — |

| Less : Indexed Cost of Improvement | — | — |

| Hence, Long term term capital Gain | — | — |

| Less ; Exemptions u/s 54, 54B, 54D, 54EC, 54F, 54G, 54GA and 54GB | — | — |

| Taxable long term Capital Gain | — | — |

Full Value of Consideration

The amount at which the parties agree to transfer the property is called as Full Value of Consideration. Such value of consideration can be cash or in Kind. It is important to understand that existence of full value of consideration is essential and not the adequacy. In case the consideration is not known the fair market value of the asset on the date of transfer is taken as full value of consideration.

Applicability of Section 50 C of the Income Tax Act, 1961

In case of transfer of Land and building Sec 50 C is applied when,

a. There is a transfer of land or building and

b. In such transfer the value of consideration is less than the value adopted by the Government for the purpose of Stamp duty payment.

In the above scenario, value considered for stamp duty will be taken as full value of consideration.

Expenditure on Transfer

Expenses incurred in order to complete the transfer are allowed to be deducted from the full value of consideration

Cost of Acquisition and indexation of cost of acquisition

Cost of acquisition is the amount at which the assessee acquired the capital asset. It is the total expenditure incurred by the assessee to acquire the asset such as brokerage paid, interest on loan, etc.

In case of Short Term Capital Gain the cost of acquisition is taken as the actual amount incurred by the assessee but in case of long term capital gain indexation is applied. Indexation is applied to find out the actual cost incurred by the assessee in consideration with the changes in the inflation rates. The value of a property acquired in 2005 and the value of same property in 2020 would be vastly different. If the cost of acquisition is taken at the rate of 2005 the long term capital gain would be very high and hence the tax payable would be more. Indexation helps to reduce this gap and gives a fair cost of acquisition.

Calculation of Indexed cost of acquisition

Indexed Cost of Acquisition

= Cost of acquisition * Cost Inflation Index (CII) of the year in which the asset is transferred / Cost inflation index (CII) of the year in which asset was first held by the seller or 2001-02 whichever is later.

Cost of Improvement

Any expenditure incurred by the assessee to increase the value and condition of a capital asset is termed as cost of Improvement. Such cost of deductible from the full value of consideration. Similar to cost of acquisition indexation is also applied in case of long term capital gain.

It is important to note that only the cost of improvement incurred after 1st April 2001, is taken as deductible expense.

Calculation of Indexed cost of acquisition

Indexed Cost of Improvement

= Cost of improvement * Cost inflation index of the year in which the asset is transferred / Cost inflation index of the year in which improvement took place

The amount calculated after deducting the above expenses is the long term or capital gain of the capital asset and liable to tax. Long term capital gains are taxed at the rate of 20% + surcharge if applicable + Cess. Short term Capital gains are taxed at the slab rates.

Deductions available for Capital Gains

The assessee has the option to claim deduction on the capital gain under section 54 by investing the amount received as value of consideration within the prescribed time and in the notified sectors. Some of the deductions that can be claimed by the Individuals are as follows.

Deduction u/s 54

This deduction can only be claimed by an Individual or HUF. Hence companies or artificial juridical person cannot claim deduction u/s 54. To claim the deduction

• The capital asset sold should be a house property

• Gain should be in the nature of long term

• The assessee should construct pr purchase a residential property in India within 1 year before or 2 years after the date of transfer if purchases or within 3 years after from the date of transfer if constructed.

If the above conditions are satisfied the deduction would be lower of

a) Investment made in the purchase or construction of the new house building or

b) The actual capital gain

If the assessee transfers such new asset within 3 years from the date of purchase or completion of construction the capital gain shall be taxable as follows : Sale Value of new capital asset- less (cost of acquisition – exemption claimed)

Deduction under section 54F

This deduction can also be only claimed by An Individual or HUF. This deduction is allowed for only those taxpayers who does not own more than 1 residential property. following conditions should be satisfied.

• Purchase of one residential House Property in India.

• Purchase should be 1 year before, or 2 year after from the date of transfer if purchased and within 3 years if house property is constructed.

Deduction = (Investment in new asset ÷ Net sale consideration) × Capital Gain

The exemption cannot be more than the capital gain.

TDS:- The buyer has to deduct TDS at 1% of the total sale consideration. Note that the buyer is required to deduct TDS, not the seller. No TDS is required to be deducted if sale consideration is less than Rs 50 lakhs. If the payment is made by installments, then TDS has to be deducted on each installment paid.

Kartik M Jain & Associates, CA in Pune is a professionally managed firm serving domestic and international clients providing services relating to direct and international taxation, indirect taxation, auditing and assurance and Consultancy. It is amongst the best CA firms in Pune. Our sister Firm, Payal K Jain & Associates, a Company Secretary in Pune provides services in relation to Company Formation in Pune and across India, Corporate Law and Compliance, ROC filings, FEMA, Trademark Registration, etc.

Our Services :- GST consultation, Chartered accountant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services.