All about TCS on sale of Goods [newly inserted Section 206C(1H)] effective from 01.10.2020 Introduction to TCS (Tax collection at source) Tax Collected at Source (TCS) is the tax payable by a seller which he bills on to the from the buyer at the time of sale and is payable into the Government Treasury on […]

Category Archives: Company Law

A Company is an artificial judicial person created by law having separate legal entity, perpetual succession and limited liability. It is an association of persons having separate legal existence from the persons forming it. Unlike some of the other forms of business enterprises the ownership and management of a company are separated. Shareholders by contributing […]

Udyam registration provides a simplified platform for the registration of Medium, Small and Micro enterprises. Udyam Registration also known as MSME Registration is nothing but a government registration that is provided along with a recognition certificate and a unique number. This is to certify small/medium businesses or enterprises. The applicant must have a valid Aadhar […]

Permanent Account Number (PAN) is a unique identification code given by the Income tax department. PAN is essential for various purposes like filing the income tax returns, opening bank account, GST registration, etc. The process of procuring a physical PAN card is lengthy and requires a minimum of 15 days. To overcome these difficulties the […]

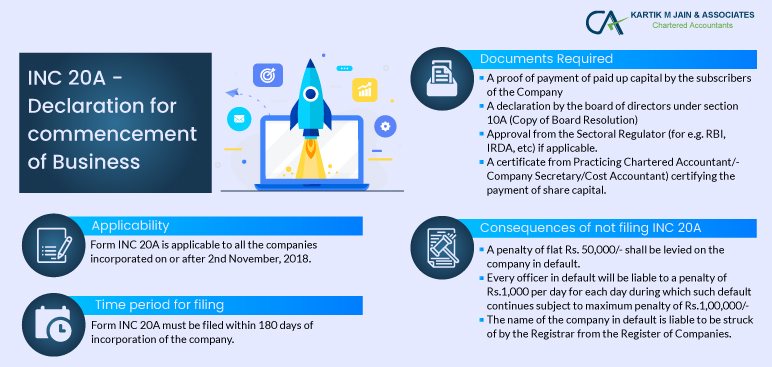

The Companies (Amendment) Ordinance,2018 requires a company registered on or after 2nd November,2018 to file a declaration of commencement of Business in Form INC 20A on the MCA website. This was done with the objective of eliminating shell companies and enhance corporate compliance. Applicability Form INC 20A is applicable to all the companies incorporated on […]

The Government of India has undertaken an initiative named as Startup India in order to facilitate innovations and simplification of processes. The Government of India is providing various incentives and Tax benefits to startups. Eligibility Criteria for Startup Recognition: An entity shall be considered as a Startup upto a period of ten years from the […]

There has been a rise in the number of Startups Registration thanks to the attractive tax holidays provided by the Government in the past few years. However, Startups registered as Private limited Companies have a lot of compliance burden. Following is the list of most of the Compliances which a Start-up is needed to follow, […]

Introduction As per section 3 (1) of the Companies Act, 2013, a company may be formed for any lawful purposes in the form of a Private Limited Company with minimum of 2 persons Public Limited Company person with a minimum of 7 persons One Person Company In a country like India where sole proprietorship form […]

Funds are the most important part for running a business. The Companies borrow funds from various sources like Banks, Financial Institutions, other Body Corporate Members, Director or Stake Holders etc. These funds are further classified into two parts viz Owned Capital and Borrowed capital or Borrowings. Owned capital comprises of funds collected by issuing shares […]